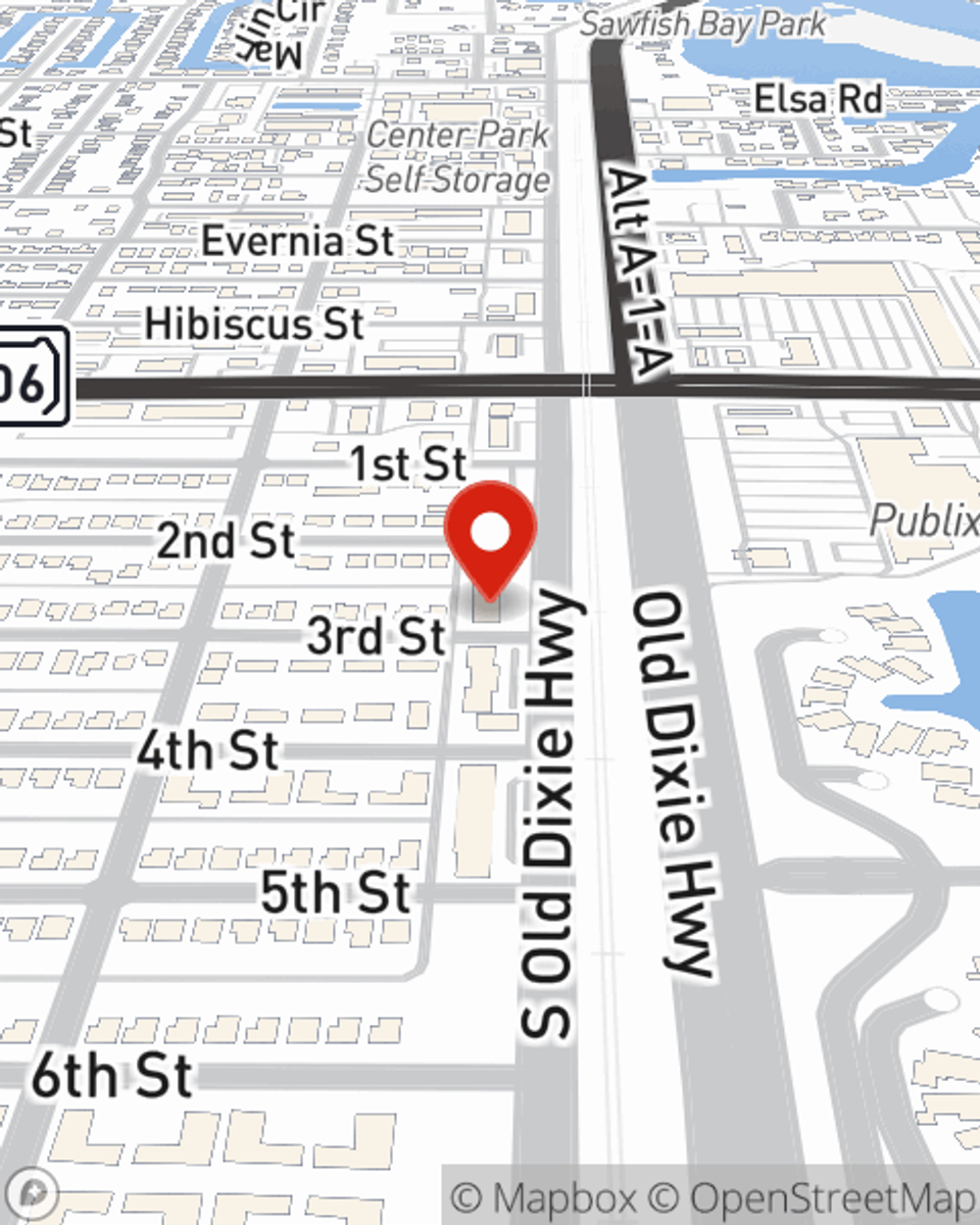

Condo Insurance in and around Jupiter

Condo unitowners of Jupiter, State Farm has you covered.

Quality coverage for your condo and belongings inside

Your Belongings Need Protection—and So Does Your Condominium.

Are you committing to condo ownership for the first time? Or have you been around the block a few times? Either way, it can be a good time to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Condo unitowners of Jupiter, State Farm has you covered.

Quality coverage for your condo and belongings inside

Safeguard Your Greatest Asset

With this coverage from State Farm, you don't have to be afraid of the unanticipated happening to your condo and its contents. Agent Kelly Hagar can help inform you of all the various options for you to consider, and will assist you in building a fantastic policy that's right for you.

Want to check out the State Farm insurance options that may be right for you and your condominium? Simply call or email agent Kelly Hagar's team today!

Have More Questions About Condo Unitowners Insurance?

Call Kelly at (561) 575-0092 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Kelly Hagar

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.